Is It Too Late To Invest In Cryptocurrencies? Not Even Close…And We’re Just Getting Started.

Plant Your Tree Now

Whenever cryptocurrencies are in a bull run, my friends, family, and coworkers reach out to me to ask whether they should invest. And like clockwork, whenever cryptocurrencies are bearish, those same friends, family, and coworkers usually make a comment or jab about how they’re glad that they didn’t invest because “Bitcoin just crashed again.”

Except, when looking at cryptocurrency charts from a 30,000-foot view, the “crash” price has been many times greater than the previous peak price, or all-time high (ATH).

What Cryptocurrency Geeks See

Ask a hundred Bitcoin enthusiasts to predict the future value of Bitcoin, and you’ll get a hundred different answers. But Bitcoin follows a fairly consistent channel pattern of breakout bull runs and bearish pullbacks and corrections.

There are countless charts, predictions, and strategies, but the following simple illustration shows where I personally believe that Bitcoin is headed.

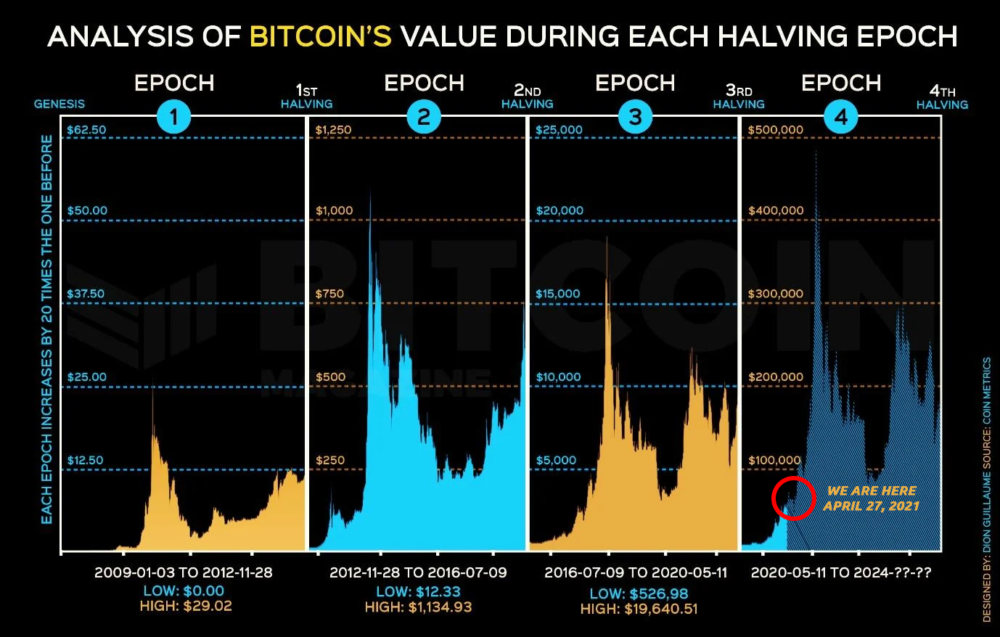

This epoch chart was published on April 11, 2021, where light blue becomes dark blue in the Epoch 4 section. And it appears to have successfully predicted this week’s price pullback, which I have circled in red:

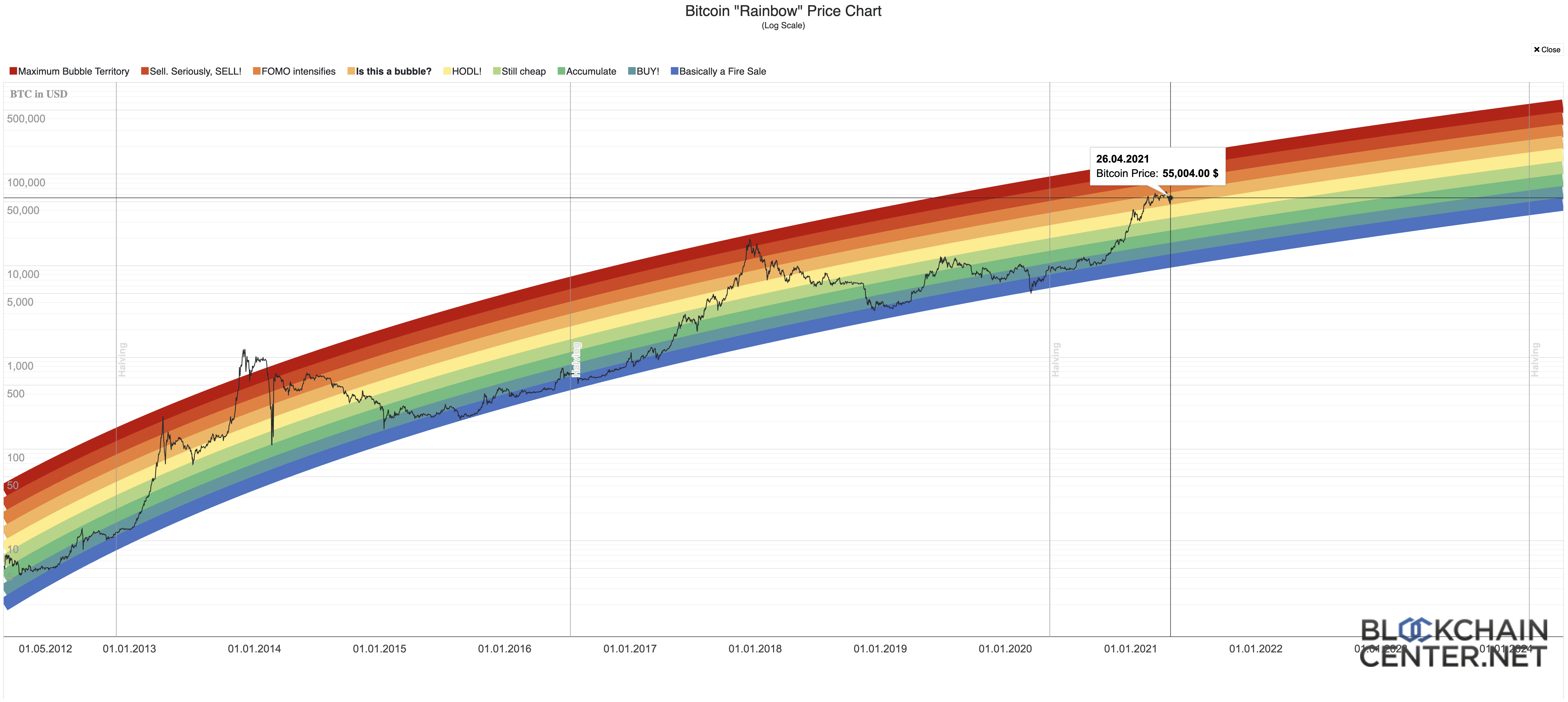

It can be scary to look at daily volatility and 10% price swings but, for long-term investments, Über Holger’s Bitcoin Rainbow Price Chart illustrates Bitcoin’s history from a 30,000-foot view. While this chart was unscientifically created for fun, it does simply illustrate the concept of floors and ceilings of resistance.

And, if you think that this chart looks a bit squashed compared to the above epoch chart, then you’re correct. Note the logarithmic US dollar (USD) values on the vertical axis:

Do Not Take My Advice, and Don’t Overthink Things

I am not a financial advisor. Past performance is no guarantee of future results. Never invest money that you can’t afford to lose. Cryptocurrencies might be a fad, or could get regulated or banned into oblivion by governments. I am not suggesting that you invest in cryptocurrencies, because you might lose everything. Then again, you might lose everything investing in the stock market.

But, if you want to invest in Bitcoin, just do it. I invest in Bitcoin, not as a get rich quick scheme, or as a retirement fund, but because I truly believe in Bitcoin and other cryptocurrencies as a path to financial independence by eliminating reliance on conventional banks.

The emotional toll from investing in Bitcoin and other cryptocurrencies, however, is similar to investing in the stock market. Between FOMO and YOLO, it’s difficult to decide when to invest. Every time I’ve said to myself, “the price of Bitcoin is too high, I’ll wait to buy the next dip,” there’s been a bull run, and the price at the next dip is more expensive than the previous peak.

So my overly-simplified thought process is now:

If the price of Bitcoin is within or below the orange “Is this a bubble?” bar on the above rainbow chart, then I feel confident making impulse buys of a couple thousand dollars here and there.

But I also have automatic Dollar-Cost Averaging (DCA) buys that execute every week. So, regardless of price, every week one of my exchange accounts automatically buys $20 USD worth of Bitcoin and $20 USD worth of Ethereum.

This completely removes emotion from the investment process.

Resources To Get Started

Since it can take up to a month to get verified on cryptocurrency exchanges, I recommend signing up for services immediately, in advance of actually planning to invest anything.

Here are the resources that I rely on daily:

Cryptocurrency Exchanges

- Binance.US

- Coinbase — Receive $10 USD worth of free Bitcoin with this link.

- Coinbase Pro — Sign in with your Coinbase account.

- Crypto.com — Receive $25 USD with this link and referral code sr7pea7fs4.

- Gemini

Hardware Wallets

- Ledger Nano X and Ledger Nano S — Get 20% off with this link.

Software Wallets

- Electrum Bitcoin Wallet

- Monero GUI Wallet — Compatible with Ledger Hardware Wallet.

You must be logged in to post a comment.